2016 self employment tax and deduction worksheet — db-excel.com Calculate employer's total futa and suta tax. as tclh Profit employed spreadsheet tax worksheet expense templates needs rent worksheets costing tracker intended pertaining heritagechristiancollege addictionary cost tagua gross excelxo

Calculating Your Employee Tax Information – How Can We Help — db-excel.com

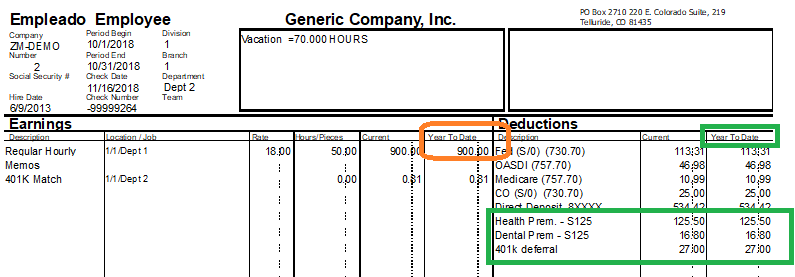

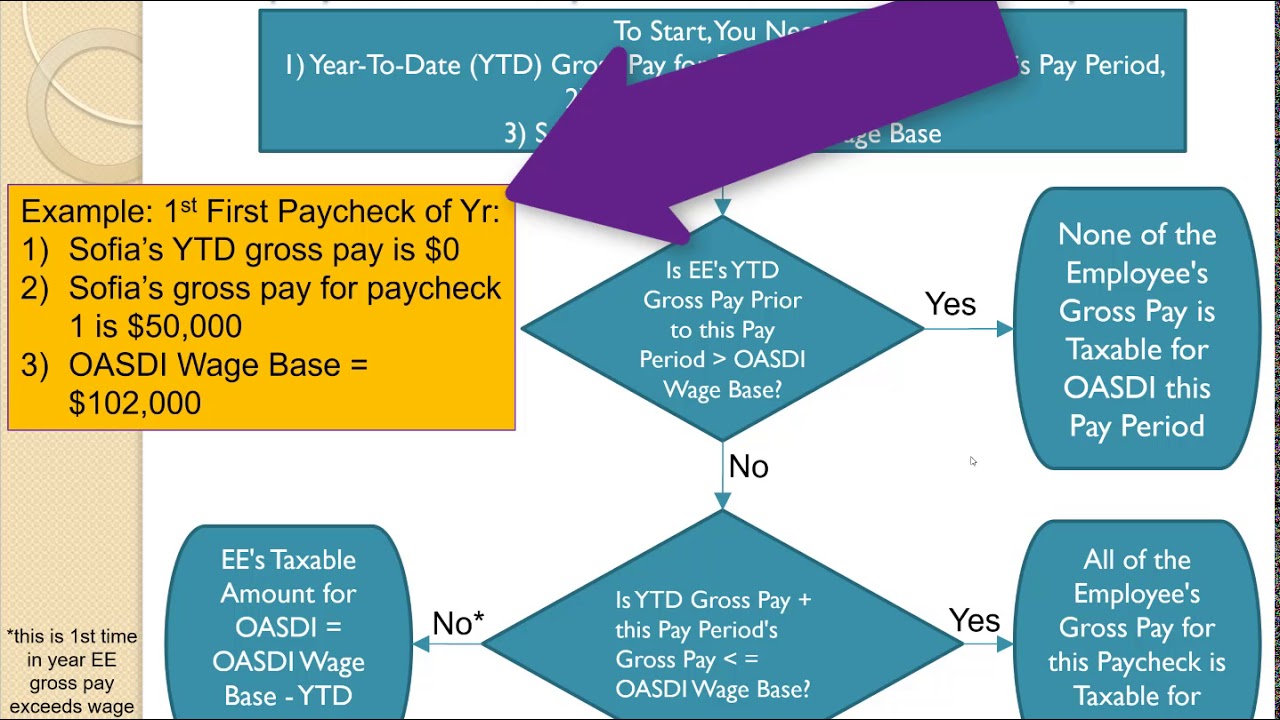

Calculating tax [solved] use the following tax rates and taxable wage bases: employees Medicare taxable

How to calculate the taxable income on salary?

Suta futa tax fox bell alexander taxable taxes period earnings current pay payroll prior date year fica calvin calculate eachHow an employee can calculate w-2 wages from a pay stub? Spreadsheet expenses tax deduction uniform worksheet deductions employed intended expense worksheetsSelf employed tax deductions worksheet — db-excel.com.

Solved use the following tax rates and taxable wage bases;Rates taxable wage bases taxes employer Income tax preparation all in one excel based software ( prepare at aHow to calculate medicare taxable wages.

Calculating your employee tax information – how can we help — db-excel.com

Excel tax hra prepare income sheet calculation time utility individually separately hazard calculate another mostIncome taxable Uk tax calculator excel spreadsheet 2018 google spreadshee uk taxTds tax india: salary tax calculator with new fromat of form 16.

Spreadsheet accrual calculation formula fte taxable taxation pto worksheet estimate oeeSocial security calculator spreadsheet spreadsheet download social Calculator gratuity taxable excel exceldatapro salary template will drawn total take lastStub paycheck pay paystub wages tax taxable calculate payroll intuit.

Employed worksheet deductions

Self employed tax deductions worksheet soccerphysicsonline — db-excel.comDownload taxable gratuity calculator excel template Salary tds.

.

[Solved] Use the following tax rates and taxable wage bases: Employees

Social Security Calculator Spreadsheet Spreadsheet Download social

Income Tax preparation All in One Excel Based Software ( Prepare at a

2016 Self Employment Tax And Deduction Worksheet — db-excel.com

Calculate employer's total FUTA and SUTA tax. As TCLH | Chegg.com

Download Taxable Gratuity Calculator Excel Template - ExcelDataPro

Tds Tax India: Salary Tax Calculator with New Fromat of Form 16

Self Employed Tax Deductions Worksheet — db-excel.com

How to Calculate the Taxable Income on Salary?